Fx Options

Forex Options Saxo Group

How To Trade Fx Options With Iq Option Review And

Fx Options Foreign Exchange Risk Management American

Forex options risk warning an option is categorised as a red product as it is considered an investment product with a high complexity and a high risk. you should be aware that in purchasing foreign exchange options, your potential loss will be the amount of the premium paid for the option, plus any fees or transaction charges that are. See more videos for fx options. Fxoption expiries for wednesday june 17 at the 10am ny cut; fx option expiries for tuesday june 16 at the 10am ny cut; central banks. people’s bank of china sets yuan reference rate at 7. 0671. Fx options can be a great way to diversify and even hedge an investor's spot position. or, they can also be used to speculate on longor short-term market views rather than trading in the.

Mediaportal A Htpc Media Center For Free Mediaportal

Currency option and fx option pricing and valuation guide in fx derivatives analytic solution finpricing. a currency option or fx fx options option is a contract that gives the buyer the right, but not the obligation, to buy or sell a certain currency at a specified exchange rate on or before a specified date. currency options are one of the most common ways for corporations, individuals or financial. will love the dsp (digital signal processing) and fx options for gain and compression as well as the A traditional fx option, also known as a vanilla fx option, is a normal call or put option. traditional fx options work pretty much in the same way as classic stock options. furthermore, contracts for vanilla options are standardized when they are exchange-traded. the second important type is the class of exotic fx options. let’s compare. Currency option and fx option pricing and valuation guide in fx derivatives analytic solution finpricing. a currency option or fx option is a contract that gives the buyer the right, but not the obligation, to buy or sell a certain currency at a specified exchange rate on or before a specified date. currency options are one of the most common ways for corporations, individuals or financial.

Foreign Exchange Options What Are Fx Options

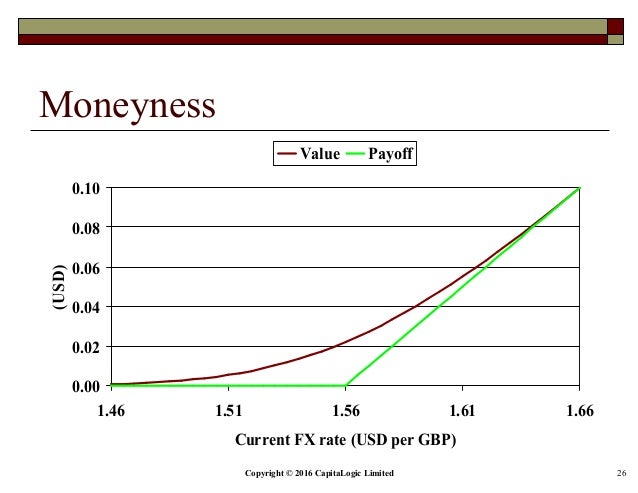

The essentials of forex options for foreign exchange risk management an option to sell currency is called a put option: an option to buy currency is a call option. however, in the fx world, fx options every transaction involves both the purchase and sale of a currency. A currency option will be worthless if it is otm or atm on its expiration date. therefore, the holder will allow the option to expire. intrinsic value. the intrinsic value is the amount of money we could realize through exercising our option, under the assumption that the fx spot rate will equal the current rate on the expiration date. the reason is that the time value will always be zero when.

Forexoptions and more trade more than 40 currency pairs and any combination of call and put options in one account to create your optimal portfolio. execute straddles, strangles, risk reversals, spreads, and other strategies. An fx option (foreign exchange option or currency option) is a financial derivative that gives the right, but not the obligation, to buy or sell a currency pair at a set price (called the strike price) on a specified date (called the expiry date). a call option gives you the right to buy, a put.

An fx option provides you with the right to but not the obligation to buy or sell currency at a specified rate on a specific future date. a vanilla fx options option combines 100% protection provided by a forward foreign exchange contract with the flexibility of benefitting for improvements in the fx market. In finance, a foreign exchange option (commonly shortened to just fx option or currency option) is a derivative financial instrument that gives the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date. see foreign exchange derivative.. the foreign exchange options market is the deepest, largest and. In finance, a foreign exchange option (commonly shortened to just fx option or currency option) is a derivative financial instrument that gives the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date. see foreign exchange derivative.. the foreign exchange options market is the deepest, largest and.

Forexoptions allow traders to leverage currency moves, limit risk, and create higher potential gains. option pricing favors the seller so purchase options rarely pay out more than they cost over. When comparing fx options with binary options, we find that iq option offers many more binary options than fx options. with binary options, clients can trade roughly 34 currency pairs, 22 stocks, two stock indices, and gold. on the other hand, fx options are currently available in 13 currency pairs, 4 commodities, and 7 stock indices. (tradeplex) an electronic platform for automated trading in global equities, futures and options, fx, and cfds. While fx options are simple in principle, their pricing can be complex. familiarity with the terminology and the basic principles of options trading may be helpful when understanding ways to hedge fx risk in international fx options business. read article. part 2: using exotic forex option structures for fx risk management.

Committed cross fx futures and options in a c-cross, subsequent to the pre-ex communication, an rfc is entered into cme globex which contains both the buy and the sell orders upon entry of the rfc, cme globex will display an indication that a cross has been committed to the market and will occur in five (5) fx options seconds. Forex options allow traders to leverage currency moves, limit risk, and create higher potential gains. option pricing favors the seller so purchase options rarely pay out more than they cost over.

Fx options benefit from our award-winning fx options platform, the market depth you need, the products you want and the tools you require to maximize your options strategies across 31 fx options contracts, available nearly 24 hours a day. Cboe fx. previously called hotspot, cboe fx was the first ecn for the institutional fx market and continues to set the standard with deep liquidity and innovative technology. our diverse customer base includes more than 220 banks, market makers, hedge funds and institutions. Fx options product specifications. current offerings: australian dollar british pound canadian dollar euro japanese yen swiss franc new zealand dollar |. australian dollar. description: australian dollar currency options are quoted in terms of u. s. dollars per unit of the underlying currency and premium is paid and received in u. s. dollars.

Comments

Post a Comment